03/22/2017

Story by:

Featured in: The Times Union

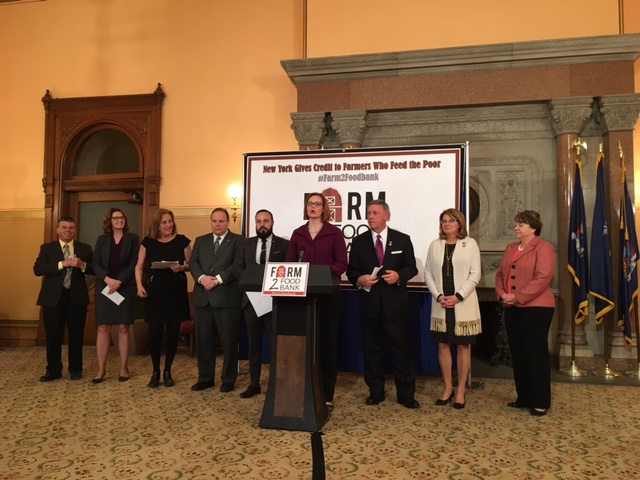

Despite alleged and recurring pushback from Gov. Andrew Cuomo, the New York Farm Bureau said Tuesday it hopes a long-sought, twice-vetoed tax credit for food donations will pass with the state budget next month.

The Farm to Food Bank credit would give farmers an exemption of 25 percent of the cost of donations to food banks and emergency food programs, up to $5,000. Previous versions of the bill had been vetoed as recently as November by Cuomo, who said at the time the bill would duplicate tax benefits already offered to farmers for their donations. Further, he said last year amid a 70-bill veto session, it “is nearly impossible to establish an accurate value for donated food,” and recommended that the bill be passed during budget sessions.

The credit goes into the April 1 deadline for the at-large state budget with support from both chambers of the Legislature for the first time. If passed, it would give significant monetary help to New York farmers, who last year donated a combined 13.2 million pounds of food — the second highest amount for any state in the country — according to the American Farm Bureau. But a state Farm Bureau official said Tuesday the credit is still being opposed by Cuomo for non-disclosed reasons.

“I’m not entirely sure why the governor would not want to help feed hungry people,” said Kelly Young, Farm Bureau deputy director of public policy. “…We’ve addressed all of his (previous) concerns, some of which were misguided. … The Legislature has done what he asked them to do.”

In a statement last week praising the bicameral budget support, the Farm Bureau encouraged Cuomo to “negotiate funding in the final budget to support the tax credit, as he promised.”

“There is no excuse for the governor to pull out his veto stamp again,” wrote the group, which represents 21,000 farmers in the state.

Cuomo’s office did not immediately respond to requests for comment on Tuesday afternoon.

Farmers are also eyeing two other tax credits that they say would alleviate the financial hardships wrought on them in recent years by, among other things, stagnating milk prices and increased labor costs.

The Farm Bureau has previously advocated for a refundable investment tax credit that would “incentivize farm investment to meet the needs of global competition in a period of very low commodity prices and weather-related crop losses,” as well as a doubling of the minimum wage tax credit to make New York farms more competitive with those in nearby states.

“No dairy farm has really made a profit in the last two years, and it’s really not looking good this year,” Farm Bureau public policy director Jeff Williams told Spectrum News last month. “… The state’s job really is to keep production costs, labor costs low so we can compete with Pennsylvania, let alone China.”